Download FedNow Transactions

Businesses, merchants, finance teams, and company account holders who are looking to download FedNow® transaction files through a bank dashboard or FinTech system and use them for Aging of Accounts Receivables (A/R).

TodayPayments.com helps businesses unify real-time payments with back-office efficiency. From creating and downloading FedNow® and RTP® files to automating A/R aging, we equip companies with the tools to track, reconcile, and accelerate revenue collection in a fully interoperable ecosystem.

To empower merchants and enterprises to leverage FedNow® and RTP® transaction data through intelligent file download tools, ISO 20022-rich exports, and automated A/R aging workflows — ensuring financial clarity, compliance, and cash flow confidence in the real-time economy.

Real-Time Payments Meet Real-Time Receivables Management

In today’s high-speed financial landscape, FedNow® and RTP® have revolutionized payment speed — but without the right data tools, businesses still struggle with reconciliation, reporting, and A/R tracking.

That’s where smart file management comes in. Using your bank dashboard or FinTech platform, you can now download FedNow® transaction files (Credits, Debits, and RfPs) in standardized formats like JSON, XML, CSV, and Excel. These files contain ISO 20022 rich messaging, enabling your team to automate Aging of Accounts Receivable (A/R) reporting and reconciliation across all transaction types.

Whether you’re the payee tracking outstanding invoices or the payer auditing real-time disbursements, TodayPayments.com gives you a competitive edge through data-driven cash flow control.

FedNow® provides real-time payment capabilities, but businesses still need to download and analyze transaction data for effective cash management, especially when managing aging receivables.

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

To support merchants and finance teams of all sizes, TodayPayments.com offers free downloadable templates, including:

- Aging Accounts Receivable Worksheet: Pre-built with 15, 30, 60, 90+ day tracking

- Bank Reconciliation Templates: Instantly match payments with deposits across batches

- ISO 20022 File Format Samples: Plug-and-play structures for batch uploads and RfP message testing

Available Transaction Types for Download:

- FedNow® Credits – Instant outbound payments

- FedNow® Debits – Authorized incoming pull requests

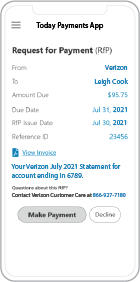

- Request for Payments (RfPs) – Digital invoicing and payment initiation

Supported Download Formats:

- .JSON – API-based structure for developer or platform use

- .XML – ISO 20022 rich format for enterprise-grade compliance

- .CSV – Spreadsheet-friendly for bulk A/R reporting

- .Excel – Flexible and editable for finance teams

Ask us how:

- Download FedNow® transaction files via bank dashboard

- Use FedNow® payment file data for aging accounts receivable

- FedNow® and RTP® download files in JSON, XML, or Excel

- Real-time payment reconciliation using FedNow® files

- ISO 20022 A/R aging reports from FedNow® credits and RfPs

These files allow businesses to map incoming and outgoing transactions against open invoices, helping identify aging A/R by customer, invoice, date range, or status.

Download FedNow® Transaction Files for A/R Aging and Reporting

How FedNow® Downloaded Files Improve Accounts Receivable Management

TodayPayments.com enables your finance team to bridge payments and accounting, ensuring real-time transactions align with receivables expectations.

📊 Automated A/R Aging Reports

Download FedNow® data and automatically categorize transactions by:

- 0–30 Days Outstanding

- 31–60 Days

- 61–90 Days

- 90+ Days Overdue

🔄 Sync FedNow® Data with Accounting Platforms

Upload downloaded files into QuickBooks, Xero, NetSuite, or your ERP platform for direct A/R and cash ledger mapping.

🧾 Real-Time Visibility Across Credits, Debits, and RfPs

Identify which RfPs are aging without response, which credits are pending, and which debits need confirmation.

🧠 Interoperability Between FedNow® and RTP®

Our unified dashboard enables downloads and reconciliation regardless of which network the payment originated from — creating one seamless A/R data stream.

From Instant Payment to Insight: FedNow® Data Files Drive Financial Efficiency

The value of FedNow® and RTP® isn't just speed — it's what your business does with the data after the transaction is complete.

With TodayPayments.com, you can:

- Export real-time payments from both FedNow® and RTP®

- Automate reporting cycles and audit trails

- Improve collections with timely A/R follow-ups

- Ensure accounting accuracy with ISO 20022-enriched payment data

The future lies in interoperability and insight, not just settlement speed.

To ensure your bank or credit union can download FedNow transactions as .csv files and utilize this data in conjunction with the Aging of Accounts Receivables (A/R) using templates from RequestForPayment.com, follow these detailed steps:

Step 1: Download FedNow Transactions from Your Bank or Credit Union

- Log in to Your Bank or Credit Union’s Online Portal:

- Access the online portal where your FedNow transactions are processed.

- Navigate to the Transaction History:

- Find the section where you can view transaction details, typically under Payments, Transfers, or a specific FedNow section.

- Export Transactions:

- Select the desired date range for the transactions you need.

- Look for an option to export the transaction history.

- Export the transactions as a .csv file and save it to your computer.

Step 2: Prepare the FedNow Transactions .csv File

- Open the .csv File in Excel:

- Open the downloaded .csv file in Microsoft Excel or Google Sheets.

- Ensure Required Columns:

- Verify the file includes necessary columns such as Payment Reference ID, Amount, Sender Account Number, Receiver Account Number, Receiver Routing Number, Payment Date, Payment Description.

- Save the Formatted File:

- Ensure the data is correctly formatted and save the file as FedNowTransactions.csv.

Step 3: Generate Aging of Accounts Receivables (A/R) Report in QBO

- Log in to QuickBooks Online:

- Access your QBO account.

- Navigate to Reports:

- Go to the Reports section.

- Run the Aging of Accounts Receivables Report:

- Search for the Aging of Accounts Receivable report.

- Set the appropriate date range and customize the report as needed.

- Export the A/R Aging Report:

- Click on Export and choose Export to Excel.

- Save the exported A/R Aging report as an Excel file.

Step 4: Combine FedNow Transactions with A/R Aging Report

- Open Both Files in Excel:

- Open the FedNowTransactions.csv file and the exported A/R Aging report in Excel.

- Prepare Data for Reconciliation:

- Ensure both files have common identifiers such as Customer ID or Invoice Number to match transactions with receivables.

- Match Transactions with Receivables:

- Use Excel functions like VLOOKUP or INDEX MATCH to correlate FedNow payments with outstanding invoices in the A/R Aging report.

- Add a new column in the A/R Aging report to indicate the FedNow payment status.

- Example Steps for Matching Data:

- Identify Common Columns: Ensure both files include columns like Invoice Number, Amount, and Customer Name.

- Use VLOOKUP to Match Payments:

- Add a new column in the A/R Aging report called FedNow Payment.

- Use a formula like =VLOOKUP([Invoice Number], [FedNow Data Range], [Column Index], FALSE) to pull payment data into the A/R report.

Step 5: Utilize RequestForPayment.com Templates

- Access Templates from RequestForPayment.com:

- Visit RequestForPayment.com and download the relevant templates for handling FedNow transactions and A/R reports.

- Customize the Templates:

- Use the downloaded templates to format your combined data. Ensure the templates include sections for Payment Reference ID, Amount, Invoice Number, Payment Status, etc.

- Populate Templates with Data:

- Fill the templates with data from your combined FedNow transactions and A/R Aging report.

- Validate the data to ensure accuracy.

Step 6: Analyze and Update the A/R Aging Report

- Check for Discrepancies:

- Identify any discrepancies between the FedNow transactions and the A/R Aging report.

- Ensure all payments are accurately recorded and applied to the correct invoices.

- Generate Updated Reports:

- Create a summary report showing paid and unpaid invoices.

- Use pivot tables and charts to visualize payment trends and outstanding receivables.

Step 7: Automate and Maintain Templates

- Regular Updates:

- Regularly download and update the FedNow transactions and A/R Aging report to keep your records current.

- Automation:

- Use Excel macros or other automation tools to streamline data matching and report generation processes.

- Validation:

- Regularly validate the data to ensure accuracy and compliance with accounting standards.

- Backup:

- Maintain backups of your templates and transaction data to prevent data loss.

By following these steps, you can effectively manage and reconcile your FedNow transactions with your accounts receivables using templates from RequestForPayment.com, ensuring accurate and up-to-date financial records.

Start Downloading & Automating A/R Today with TodayPayments.com

You’ve embraced real-time payments. Now it’s time to unlock real-time reconciliation.

✅ Download FedNow® Credits,

Debits & RfPs in JSON, XML, CSV, or Excel

✅

Create aging reports for accounts receivable in minutes

✅ Integrate with accounting platforms for seamless

A/R matching

✅ Access transaction data from

both FedNow® and RTP® in one portal

✅ Stay

compliant with ISO 20022 and reduce A/R friction

📥 Get smarter with your

receivables.

Visit

https://www.TodayPayments.com and start downloading

FedNow® transaction files with confidence and clarity.

How to Download FedNow Transactions through files as .CSV and use Aging of Accounts Receivables A/R

Request for Payment, a new standard for digital invoicing facilitating real-time payments RTP ® and FedNow ®

payments that are instant, final (irrevocable - "good funds") and

secure.

Request for Payment, a new standard for digital invoicing facilitating real-time payments RTP ® and FedNow ®

payments that are instant, final (irrevocable - "good funds") and

secure.

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Reconcile invoices with our Download FedNow Transactions through files as .CSV and use Aging of Accounts Receivables A/R Solutions

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.